When Uncertainty Hits Home in Pemberton

If you’ve searched for “foreclosure help in Pemberton, NJ,” you are likely dealing with one of the most stressful financial events a homeowner can face. The feelings of panic and uncertainty are completely valid, whether the situation stems from job loss, unexpected medical bills, or an unfortunate divorce.

Your immediate need is a clear path forward: How do I stop the foreclosure process? What are my options in Pemberton? And is there a way out that doesn’t completely destroy my financial future?

This guide is designed to provide Pemberton homeowners with practical, actionable information. We will outline the foreclosure process, explore the alternatives to losing your home, and, most importantly, highlight a powerful, fast-track solution that many homeowners overlook: selling your house quickly for cash to a local investor.

Understanding Foreclosure in Pemberton, NJ

Foreclosure is the legal action initiated by a lender to recover the balance of a defaulted loan by forcing the sale of the property. For residents of Pemberton, understanding that this is a stressful but solvable problem is the first step.

The clock is ticking, and while the New Jersey legal process can be long, delaying action is the most damaging thing you can do. Foreclosure is a public record that will severely impact your credit, making it difficult to rent, buy a car, or obtain future financing for years to come.

How the Foreclosure Process Works in New Jersey

New Jersey is a judicial foreclosure state, meaning the lender must go through the court system to take possession of your home. While this often makes the process longer than in other states, it does not mean you have unlimited time.

- Missed Payments: The process formally begins after you miss a few monthly mortgage payments.

- 90-Day Notice (Notice of Intent to Foreclose): By law, the lender must send you this notice at least 30 days before filing a formal foreclosure complaint with the court. This is a critical window of opportunity.

- The Complaint: The lender files a lawsuit with the Superior Court of New Jersey. You must respond to this legal complaint within 35 days, or you risk a default judgment.

- Final Judgment and Sheriff’s Sale: If you do not resolve the debt, the court issues a final judgment, and your property is scheduled for a Sheriff’s Sale (auction).

The entire timeline can take 6 months to over a year, but the moment you receive the Notice of Intent, you need to be exploring all your exit strategies.

Can I Stop the Foreclosure on My Pemberton Home?

Yes, you can absolutely halt the process, but you must move fast. Here are the three primary options available to homeowners in Pemberton:

1. Loan Modification or Forbearance

You can contact your lender and ask to modify the terms of your loan. If you are experiencing a temporary hardship, they may agree to a forbearance (a pause or reduction in payments) or a loan modification (a permanent change to the interest rate or term). This requires extensive paperwork and bank approval, and there is no guarantee it will be approved.

2. Short Sale

A short sale involves selling your Pemberton property for less than the total amount you owe on the mortgage, with the bank’s permission. While it avoids the worst consequences of a full foreclosure, it is a complicated, lengthy process that requires lender approval, which can take several months, and often falls apart.

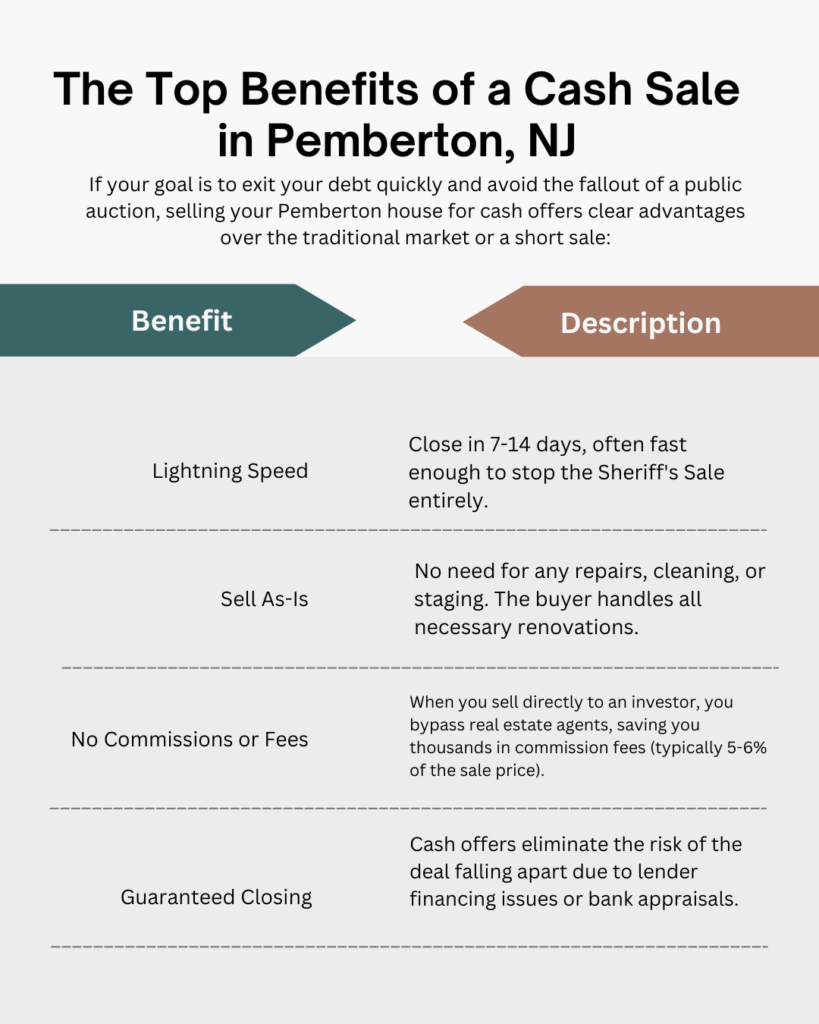

3. Sell to a Cash Home Buyer

If speed, simplicity, and certainty are your priority, selling to a local cash investor is often the best solution. A cash buyer can close on your home in as little as 7 to 14 days, providing the funds necessary to pay off your mortgage before the Sheriff’s Sale deadline. This method eliminates the need for bank approval or lengthy negotiations.

The Critical Cost of Inaction

What happens if you simply wait? The consequences of allowing a foreclosure to finalize are severe and long-lasting:

- Credit Ruin: A foreclosure will remain on your credit report for up to seven years, severely limiting your ability to secure loans, credit cards, or a new home.

- Loss of Equity: You lose any and all equity you have built in your home. The bank sells the property at auction, and you receive none of the profits.

- Deficiency Judgments: In some cases, if the auction price doesn’t cover the full debt, the lender can pursue you for the remaining balance (a deficiency judgment), leaving you with debt even after losing your house.

The sooner you act, the more of your credit score and financial stability you can save.

Take Control of Your Future Today

Facing a foreclosure in Pemberton, NJ, is terrifying, but it is not a dead end. By understanding your options and acting quickly, you can choose a path that minimizes financial damage and secures a fresh start.

For many homeowners in your position, the speed, simplicity, and certainty of a cash sale to a local investor make it the clearest choice. It allows you to walk away from a bad situation with cash in hand, preserving your dignity and financial health far better than a final foreclosure judgment.

If you are ready to explore your options and see how quickly you can get out from under the burden of a potential foreclosure, contact a Pemberton home buying specialist today for a fair, no-obligation cash offer. Take that first step now – the peace of mind is worth it.